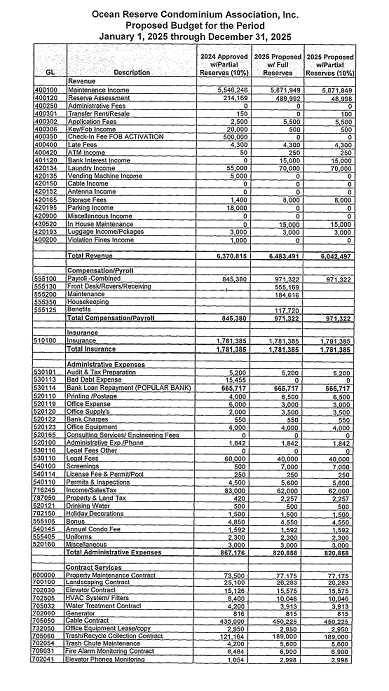

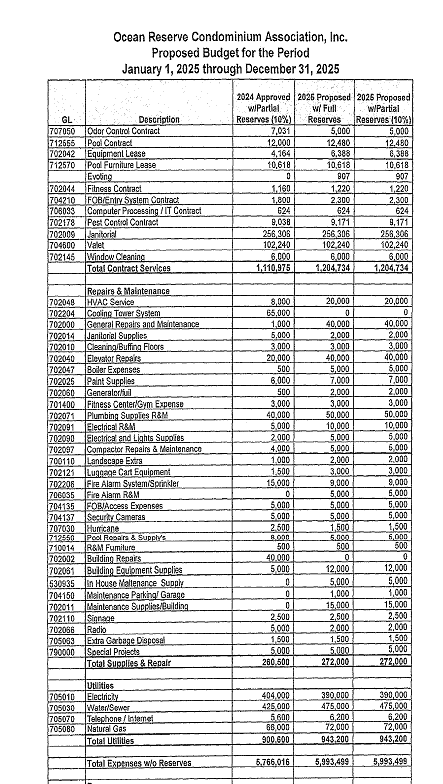

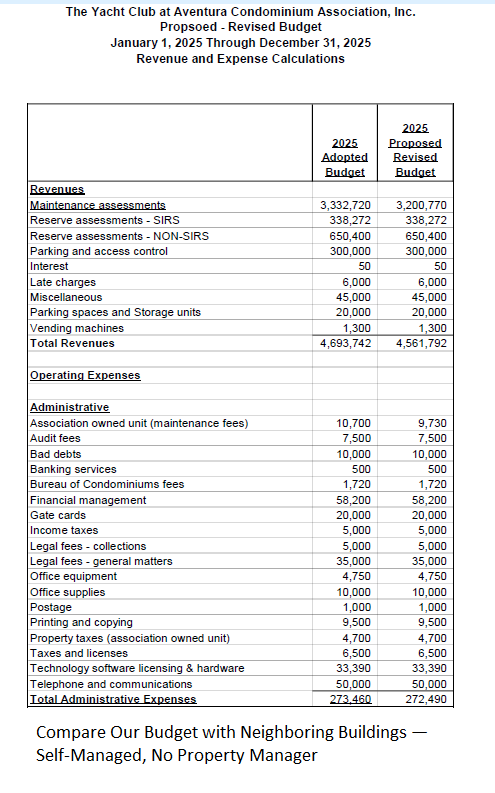

Ocean Reserve: Loan, Deficit, and Financial Burden

🔹 Current Financial Situation

According to the audited financial statements of Ocean Reserve Condominium Association for the year ended December 31, 2024 (prepared by Gerstle, Rosen & Goldenberg, P.A., August 2025):

Outstanding loan balance: $6,796,341

Accumulated operating deficit: $1,547,909

On pages 16–17, AUDIT of the report it says: For the year ended 2024, the Association has a current operating deficit of $84,937, and an accumulated fund deficit of $1,547,909.

The deficits arise from the following years:

2022 – (851,240)

2023 – (1,462,972)

2024 – (1,547,909).

The Association could increase assessments, pass a special assessment or delay expenditures if possible in order to rectify this situation.

This means the Association is carrying both a structural deficit of over $1.5 million and a loan obligation of nearly $7 million at the same time.

🔹 Loan Repayment and Overpayment

The loan of $8 million was approved in 2022, with a 5-year repayment schedule at 4.72% interest.

The intent was simple:

Loan proceeds should pay the contractors for the 50-year recertification, roof replacement, façade restoration, and related works.

Unit owners would gradually repay the bank through a special assessment of $8 million.

However, the audit shows:

Only about $1.2 million in principal and $0.3 million in interest have been paid to the bank.

Unit owners have already contributed approximately $4.5 million in special assessment payments.

Instead of being applied primarily to the bank, part of these owner contributions was also used to pay contractors, despite the fact that unused loan proceeds (about $4 million) were still available on the Association’s accounts.

As a result, the loan principal remains nearly unchanged, and interest continues to accrue.

👉 This practice extends the effective repayment period from the intended 5 years to approximately 7–8 years.

👉 Owners will ultimately pay not just the $8 million principal, but closer to $10 million (including interest).

🔹 Why This Matters

The Association is currently using both credit funds and owners’ direct payments for contractors.

This approach leaves the loan largely outstanding and increases total interest costs.

The burden on owners grows:

≈ $6.8 million loan still owed,

≈ $1.5 million accumulated deficit,

≈ $2 million in additional interest payments expected.

In total, owners are facing a financial load of over $10 million, while many repair projects remain unfinished.

🔹 Legal Framework

Under Florida Statutes, Chapter 718 (Condominium Act), the Board of Directors has a fiduciary duty to manage association funds responsibly, transparently, and in the best interest of the unit owners (see Fla. Stat. §718.111(1)(a)).

The current financial practice — where owner contributions are diverted to contractors instead of directly reducing loan obligations while unused loan proceeds remain idle — raises serious concerns of mismanagement and lack of financial prudence, even if not outright fraud.

🔹 Conclusion

We, the unit owners, must recognize:

The Association’s current financial management is prolonging debt, increasing interest costs, and deepening deficits.

If this style of management continues, Ocean Reserve will face even greater financial shortfalls and the likelihood of additional assessments.

⚖️ This summary is based on the audited financial statements of Ocean Reserve Condominium Association, Inc. for 2024. It is provided to inform owners about the Association’s current financial condition under the obligations set forth in Florida Statutes Chapter 718.